API first ticketing

Future Ticketing’s leading high-performance

software and API empowers venues and events

to sell tickets, manage your business and build

partner integrations.

Key Features

Building next-generation, API-First ticketing

Building next-generation, API-First ticketing

A unified platform

A unified platform

Go beyond tickets, increase profits

Data and Analytics

Data and Analytics

The complete ticketing solution for sports, visitor attractions, venues and events

- A unified platform for API First ticketing

- Build your data ecosystem – integrate with CRM, EPOS, social platforms and payment systems

- Develop Single Customer View and 360° insights

- Create unique customer experiences through limitless API partner integrations

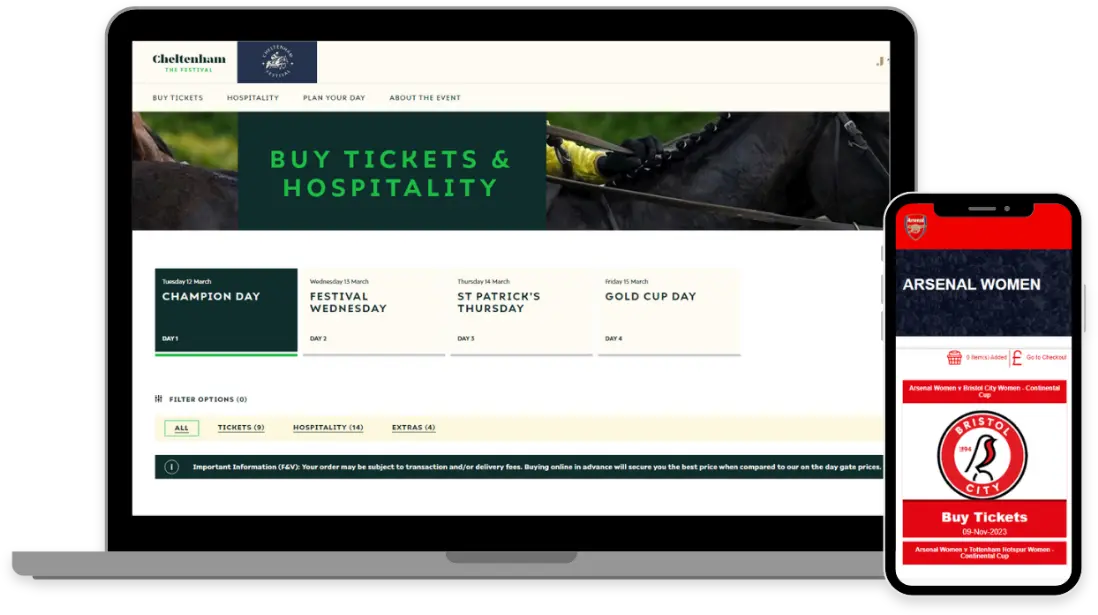

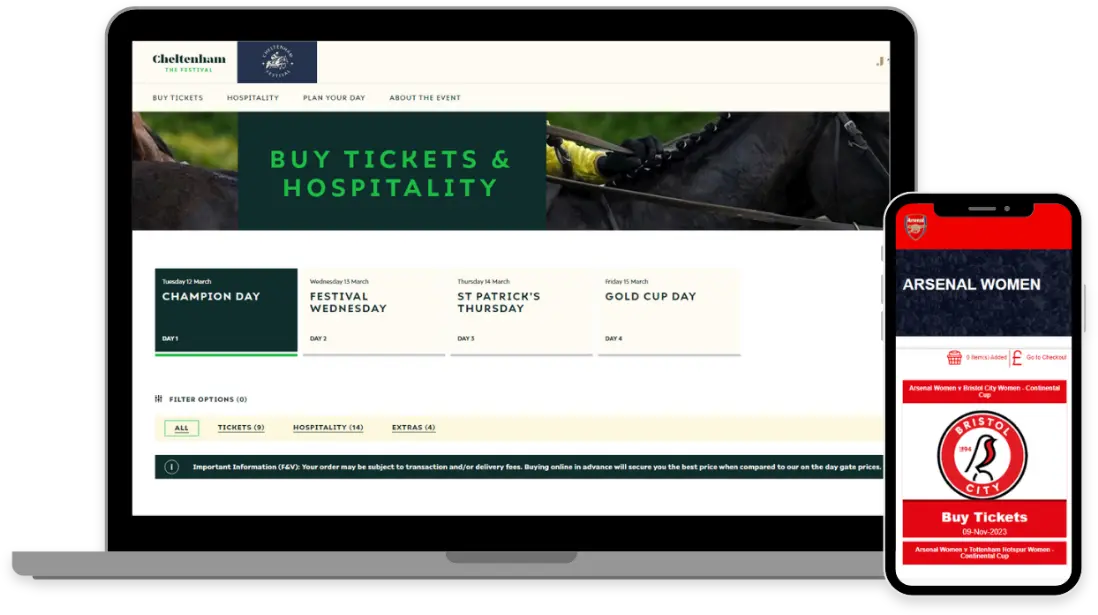

- No redirects, your customer stays on your website

- Flexible and customised white label solutions

- Fully integrated data-collection opportunities

- We believe in empowering you to build a deeper relationship with your customer

- Your customer data is hosted in a GDPR-compliant individual database, the data is owned and controlled exclusively by you

- The perfect combination of technical experts and product innovation

- We believe in people and we believe in relationships

- We promise that you will have a team of experienced people available

The complete ticketing solution for sports, visitor attractions, venues and events

- A unified platform for API First ticketing

- Build your data ecosystem – integrate with CRM, EPOS, social platforms and payment systems

- Develop Single Customer View and 360° insights

- Create unique customer experiences through limitless API partner integrations

- No redirects, your customer stays on your website

- Flexible and customised white label solutions

- Fully integrated data-collection opportunities

- We believe in empowering you to build a deeper relationship with your customer

- Your customer data is hosted in a GDPR-compliant individual database, the data is owned and controlled exclusively by you

- The perfect combination of technical experts and product innovation

- We believe in people and we believe in relationships

- We promise that you will have a team of experienced people available

Digital ticketing for every event

Trusted by premium brands in sports, venues and events

Trusted by premium brands

in sports, venues and events

Latest partner profiles from Future Ticketing

Latest partner profiles

from Future Ticketing

Shamrock Rovers F.C.

Working in football, everything moves so fast on a daily basis. With Future Ticketing regardless of the day or hour I know I have something to help or advise on set up or ideas. We’ve seen this so much over the last couple of years with Covid test sites, European qualifications and year-on-year growth in season tickets sales. We’ve been able to constantly grow and improve with Future Ticketing.

Sports

Sports

Sports

Sports

Sports

Visitor Attractions

Single Day Events

Shows, Fairs, Festivals

Single Day Events

Shows, Fairs, Festivals

Shows, Fairs, Festivals

Shows, Fairs, Festivals

Sports

Sports

Sports

Sports

Sports

Sports

Sports

Sports

Sports

Sports

Sports

Sports

Sports

“We’ve added Future Ticketing to our list of integrated partners. And they have the best API we’ve seen so far in the industry.”

Activity Stream